Charged EVs | CarbonScape pioneers a process to produce graphite locally from forestry byproducts

Cracking the carbon code

Graphite, a crystalline form of carbon, is a critical ingredient in EV battery anodes, but it comes with some baggage. Most graphite is made from fossil fuels, and what’s worse, the vast majority of it comes from China, and establishing reliable sources of supply elsewhere is a long and complicated process.

CarbonScape offers an alternative—it produces graphite locally from renewable timber industry byproducts through what it calls a carbon-negative process. CarbonScape’s graphite is engineered for lithium-ion battery anodes, and it can be produced in any region that has a forestry industry.

Charged recently chatted with CarbonScape Chief Commercial Officer Vincent Ledoux Pedailles to learn more.

Charged: Tell us how you got into the biographite business.

Vincent Ledoux Pedailles: I worked in the lithium industry for most of my professional career, and I’m now focusing on graphite. As a company CarbonScape looked into the graphite market back in 2015, and saw a significant challenge that still exists today—more than 95% of all graphite is currently supplied from China. Producing graphite is difficult, and very polluting—for every ton of graphite you produce, you’ll emit between 15 to 25 tons of CO2, which is obviously not in line with what the EV industry is trying to accomplish.

It’s also very difficult for graphite projects to be financed outside of China, and that’s mostly because they can’t compete on price. Many graphite projects within the US have been asking for tariffs to be able to compete against Chinese prices, which is not something we need, but I’ll come back to this later. For us, the idea was to develop a different type of graphite that could be produced anywhere, and also could be affordable.

Today, to produce graphite, typically you’re going to be using either a mined product, or a refined product. You mine flake graphite in Africa or South America, and export it to China to be converted.

Today, to produce graphite, typically you’re going to be using either a mined product, or a refined product. You mine flake graphite in Africa or South America, and export it to China to be converted. Or you obtain petcoke or needle coke [carbon-rich solid materials derived from oil refining], and you graphitize it at very high temperature to obtain a graphite product that can be used in a battery application. So, you’re relying on either the oil industry or the mining industry, which means that your pricing structure is going to be quite volatile.

At CarbonScape, we are buying a biomass feedstock. We’re basically buying wood chips, which are widely available in the US, especially in the Southeast, and are pretty cheap. We’re going to be buying a ton of wood chips for maybe $70 to $80. You’d pay a lot more to buy a mined product or a refined product. We extract the carbon, which is contained within this byproduct from the forestry industry, and we convert it into graphite. It’s not something that we developed overnight—it took us many years to develop a process, optimize it, and work with battery cell makers and EV makers on the specifications of the end products, and to align with their performance metrics.

We extract the carbon, which is contained within this byproduct from the forestry industry, and we convert it into graphite.

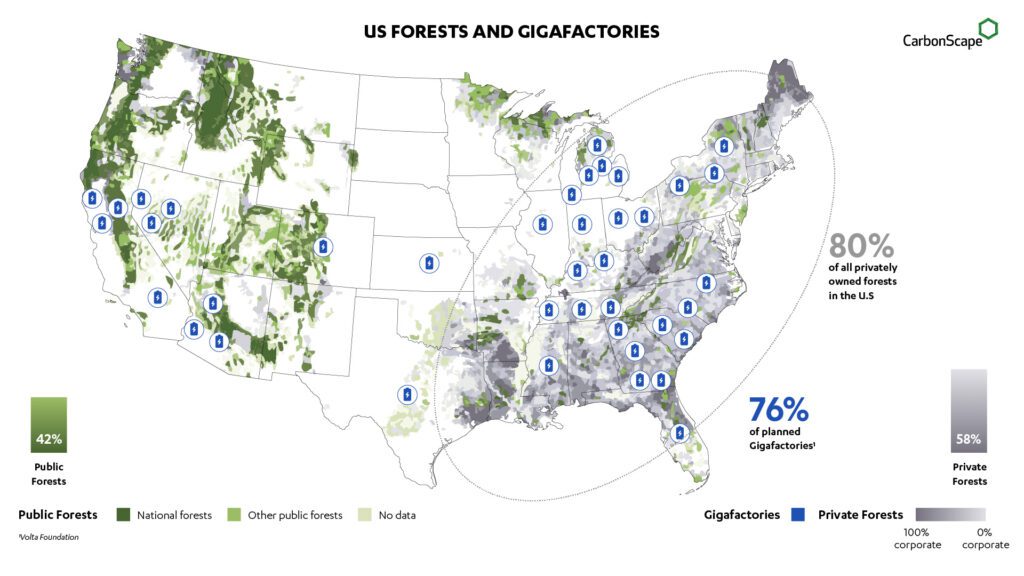

What we are selling is a biographite that is more environmentally friendly than the traditional graphite product, that can be low-cost, with stable pricing, and that can be manufactured domestically. You can source your feedstock directly from the Southeastern forests, convert it into graphite, and use it directly in local gigafactories, without having to source anything from outside of the US.

Charged: Where are you right now in the process of developing your biographite?

Vincent Ledoux Pedailles: Because it’s a new product, it needs to be tested and validated, so over the years we’ve worked with a number of battery cell makers, mostly in Asia—in South Korea, Japan and China—to test our product in battery cells, and to make sure that the material overall is good enough, but we have seen that our biographite is actually better than our competition across key parameters.

So far, we’ve been running our assets out of New Zealand. We’ve got a pilot plant located there, which is producing samples that we are exporting to Europe, North America and Asia for testing. But what we are looking at doing is scaling this up to what we call the demonstration plant, which will be the last step for us before we go industrial-scale. The reason we’re building demonstration plants is to allow us to produce larger samples for the battery cell makers, and for the EV makers to finalize their qualification work on our products. To do this qualification, EV makers need larger volumes of material.

At the moment, we are financing our demonstration plants, then we’ll move to industrial facilities. We’ve already looked at a number of potential sites to build those commercial plants. One of the obvious sites is in Europe, specifically in Finland. CarbonScape has been backed by strong cornerstone investors to date, including forestry giant Stora Enso, lithium-ion battery leader ATL, and PTL, an anode manufacturer.

We’ve also secured a number of supply agreements with forestry companies in the Southeastern US. We’ve done a lot of work in East Texas, Alabama, Arkansas and Mississippi. We’ve identified potential sites and partners to look at building our first commercial assets in the US. We want to develop two regional markets—a production hub in the EU, and another in the US Southeast. But who comes first will be decided within the next few months.

Most of the battery material qualification partners we work with downstream are headquartered in Asia, but they have joint ventures with US EV makers, and are now developing or have already developed factories to produce battery cells within the US. So all the qualification work we’ve done in Asia is very useful as we look into entering the US market.

Charged: Do you plan to produce and sell the graphite to cell makers, or to license your technology?

Vincent Ledoux Pedailles: Licensing is definitely an option for the longer term. Once we’ve shown that our technology works at scale, we are happy to consider licensing our technology to other regions or other countries. But when it comes to delivering the first factory, this is something we want to do as a company with an industrial partner. We’ve already been approached to license our tech, but we think it’s too early—we want to make sure we maintain technology custodianship to get it to industrial scale.

Charged: The ever-changing tariff situation seems like bad news for a lot of industries, but it could be good news for you, because it’s going to make graphite from China even more expensive.

Vincent Ledoux Pedailles: At the end of the day, we don’t like the end customers having to pay more to buy an EV. Yes, short-term, it’s good for graphite, but I don’t think it’s ever a good long-term solution. You can never bet on having a profitable project just on the back of import duties. And when you go to your equity partners and your lenders, and they realize that your project doesn’t work without tariffs…you can’t rely on that. When we present our numbers, we always discuss the duties and we say, “We can have a competitive product in the US markets against Chinese prices, excluding all duties.” If we can’t prove that, I think it’s going to be very difficult for us to build a project in the US. We see other graphite projects asking for higher and higher duties. There was a group of three or four graphite projects who went to DC to ask for something like a 974% import duty on graphite from China to be able to sell their graphite. It’s going to be very difficult for those ventures to borrow money, or to get equity invested in the project if they need that to survive.

Feedstock cost is probably around 20% of our total cost structure, so that for us is the game-changer. Also the fact that it’s renewable, it has stable pricing, and it’s available domestically.

That’s why our approach of sourcing domestic feedstock, which is much cheaper than petcoke and needle coke, allows us to be competitive. Your typical cost structure for graphite in China has 40 to 60% of its base cost as feedstock costs. Feedstock cost is probably around 20% of our total cost structure, so that for us is the game-changer. Also the fact that it’s renewable, it has stable pricing, and it’s available domestically.

Charged: Near where I live in Florida, the forestry industry is big—lots of sawmills and processing plants.

Vincent Ledoux Pedailles: There’s some volume available in Florida, but the market is much larger in Alabama, East Texas and Mississippi.

Charged: You say your feedstock is wood chips. Is that a waste product from the forestry industry, or is this a byproduct that they sell?

Vincent Ledoux Pedailles: We currently use wood chips because it’s easy to source, and because it’s a very basic commodity. However, we can use any type of wood products. It can be thinnings from mainstream forest, it can be sawdust, it doesn’t really matter. We can process any of those products. When it comes to wood chips, the main types we’ve been sourcing so far are traditionally used in the felt and paper industry.

It doesn’t mean that the product we will eventually source will be diverted from a sawmill, because that’s not the aim. But currently it’s been easier for us to source those wood chips from the suppliers. Eventually the goal for us is to source only so-called side-stream material, for us to further chip and then pyrolyze into biochar, as opposed to sourcing wood chip material that potentially could be used in other applications such as wood pellets, which is a big market in the US. You’ve got around two million tons of wood pellets being produced for energy purposes, but a large part of it is also exported to the EU (which makes no sense, but it’s an attractive market for US producers). Eventually that will stop and there will be a lot more volume available in the market, so we could also be sourcing this type of material to be converted into biographite, which is much better. And when you think about the waste, if it’s not collected by someone, it will just sit there, and then eventually the carbon that has been captured by the growth of a tree will be released into the atmosphere. What we propose is to pick it up, to transform it into graphite, and to lock the carbon in the graphite product to be used into a battery application.

Charged: So there is a certain amount of wood chips and byproducts that just gets thrown away.

Vincent Ledoux Pedailles: Forestry is a pretty tough industry to be in, and in some parts of the Southeast there’s a large volume of wood product that is unused. We represent a new market for forestry groups that they have no idea about. That could help them to access a new market—the EV and energy storage markets—and also to add further value to the byproduct, which had a limited value before because it was only used to burn, or to use in felt and paper, which have a more limited budget compared to what we see in graphite anodes.

Charged: You say your process is actually carbon-negative. Is that because you’re using waste products that would otherwise decompose and release carbon into the atmosphere?

Vincent Ledoux-Pedailles: You have a few things to consider here. Yes, you are using a product which has captured carbon during its growth as trees, but then you’re going to process those wood products, so some emissions will be generated. A lot of those emissions are going to be transformed into what we call syngas. When you convert a wood chip, for example, into what we call a biochar, you’re using a pyrolysis process. And as part of this pyrolysis process, you have different emissions coming out. And those emissions are actually a source of energy that comes in the form of oxygen, hydrogen and carbon.

When you convert wood chips into biochar, you produce syngas, which is a renewable source of energy that we also use as part of a process to produce graphite. Syngas replaces [methane, so-called “natural gas”] in our industrial process. It’s produced as part of the heat treatment. The wood chip is a green product—it contains moisture of around 50%, so you want to heat-treat it and convert it to a char. As part of this process, you’ll be producing as a byproduct this syngas, which you can reuse to generate heat.

So, part of the carbon is captured, part of the carbon is released, but a portion of the carbon is locked within the graphite, which is then used in a battery. So essentially, the negative part is the part that remains in the product, which is used in the battery application.

Charged: Tell us more about the different types of graphite. As I understand it, synthetic graphite and natural graphite are different, and both are used to make a battery anode.

Vincent Ledoux Pedailles: Yes, the main types of graphite we currently see in the market are synthetic graphite and natural graphite. Spherical graphite and coated graphite are more refined versions of natural graphite. When you produce natural graphite, it then needs to be spheroidized to be coated, etc, to be used directly in a battery application. Traditionally, synthetic graphite has better performance than natural graphite, and is also slightly more expensive.

Within a battery cell, you tend to mix both types of graphite within the same anode material. Depending on what you want to achieve from a performance perspective, you’ll use a different ratio of natural versus synthetic. If you want a very high-performance, more expensive battery, you use mostly synthetic. If you don’t mind too much about some aspects of the performance, you can use a greater proportion of natural graphite. But it’s not as simple as that, because every natural graphite product or synthetic graphite product is different, and has its own specification. It’s very far from being a commodity. Every single graphite product has a different price, and needs to be tailored for the specific application it’s going to go into.

Therefore, what you’re going to do is tailor your product to a specific customer. Traditionally, from one plant, you’re not going to have ten different customers, you’re probably going to have one, two or three. So, you have to start working with your partners very early on, especially if you build a new site, to make sure you fully align with their expectations from a performance perspective. As a company, it’s why we start working so early with the cell makers in the US, to make sure that by the time we go to production, we’ve got a product which is already tailored for them. Because if we wait to start producing at industrial scale, it means we still need one to three years to adapt the product to what they want.

We are looking at starting production from our new demonstration plant next year, and we will start construction of our first industrial-scale plant in 2027.

Charged: So, you’re able to produce different types of graphite to meet customers’ specifications?

Vincent Ledoux Pedailles: Yes. We’ve already been customizing our graphite products for a range of different cell makers. One of our first investors is a company called ATL, which was initially the parent company of CATL, the largest lithium-ion battery maker in the world.

We’ve also been working with South Korean and Japanese companies supplying batteries to large automotive OEMs. We have a standard recipe with standard specifications that we send out for testing with our cell makers. Then they send us their feedback on what we should adapt to be aligned with their performance metrics, and that optimization work or adaptation work takes quite a bit of back and forth before you get it right. You define a base product first, and then you work with the cell maker to optimize it further.

Charged: We’ve covered a couple of companies that are working on replacing graphite in the anode with silicon.

Vincent Ledoux Pedailles: Today, and for the next five to ten years, they’re talking about replacing part of the graphite needed in batteries, not all. Silicon doping is great to improve performance of an anode. We ourselves also do silicon doping within anodes to be able to deliver better performance. But when we talk about fully replacing graphite within batteries, we’re really talking about longer-term solutions, which at the moment can’t be implemented technically or economically.

Charged: Do you have any competitors in this space? Is anyone else making biographite?

Vincent Ledoux Pedailles: No. You have companies working further upstream converting wood chips to biochar. You have some companies who have been looking at converting all types of biomass into carbon, but I think it’s a very early-stage process. None of those companies have done the amount of testing we’ve done, or the amount of validation we’ve done directly with battery cell makers. Overall, I don’t know of any competitors at this stage, and we’re well-protected on the patent side as well.

Charged: How long before we see your graphite in a vehicle on the road?

Vincent Ledoux Pedailles: We are looking at starting production from our new demonstration plant next year, and we will start construction of our first industrial-scale plant in 2027. Depending on whether we pick the US or Europe, it will take between a year and a half to two years to start production, so we anticipate that, at the earliest, we can be in the market in late 2028 or early 2029.

This article first appeared in Issue 72: April-June 2025 – Subscribe now.