Charged EVs | Choosing the perfect sites for EV charging projects: EVpin’s all-in-one site selection and design tool

Q&A with EVpin CEO and founder Maythem Alsodani

- Site selection is a critical part of any EV charging infrastructure project, but obtaining the necessary information to make data-driven decisions can be extremely complicated. EVpin aggregates a wide range of data in an online tool that allows CPOs or other charging providers to evaluate different sites.

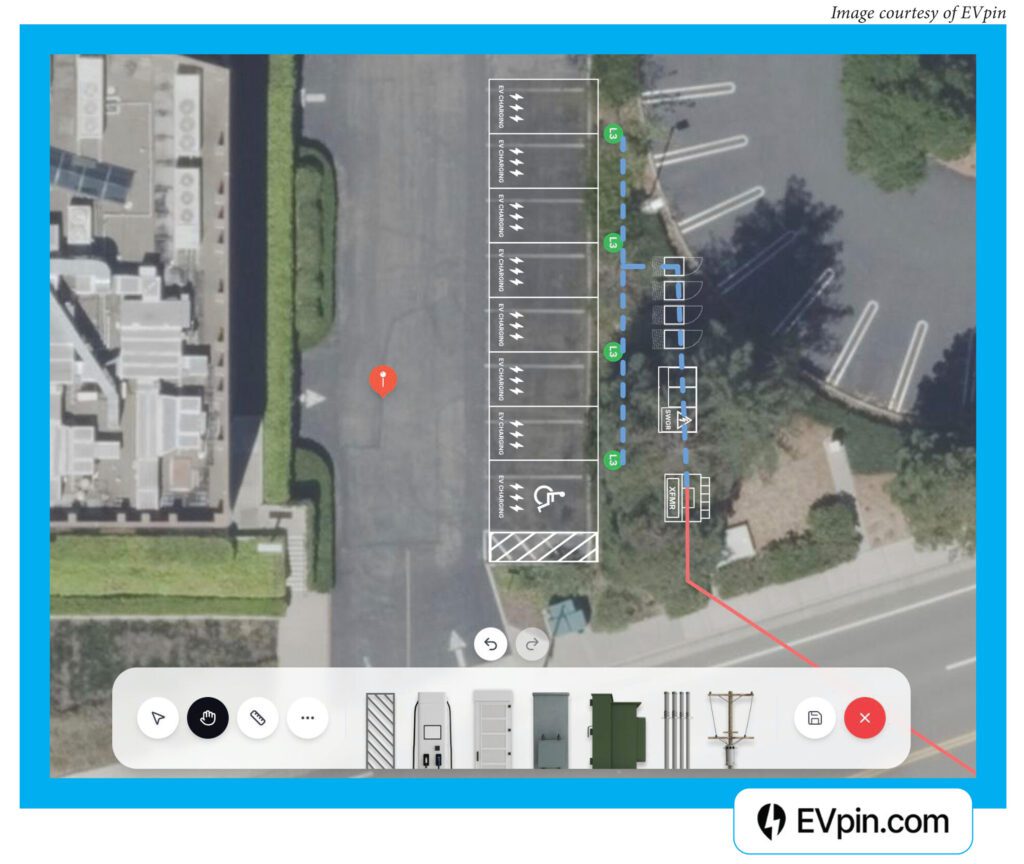

- EVpin’s platform also includes tools for designing charging sites, and for creating 3D renderings of proposed sites, which can be helpful when creating proposals for site hosts or permitting authorities.

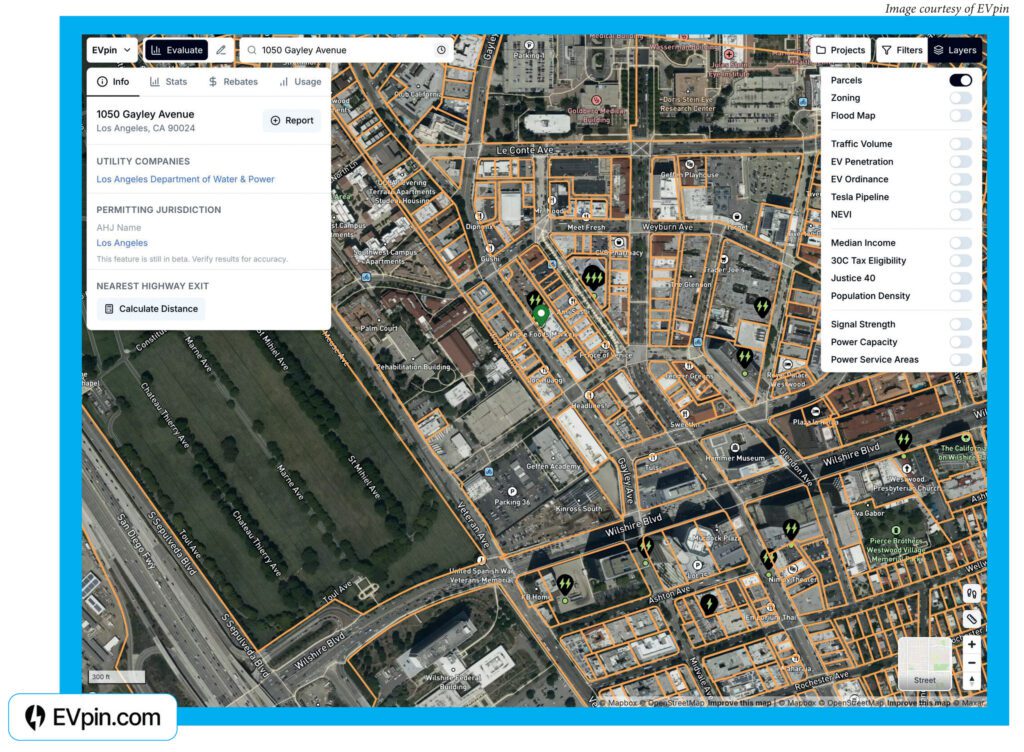

- Different types of charging sites have different criteria for site selection—for example, a good site for a public charging facility may have very different attributes from a suitable site for a fleet charging depot. EVpin’s tool allows users to toggle map layers with different site selection criteria.

Whatever kind of EV charging facility you’re planning to deploy—from a Level 2 destination or multi-family site to a highway DC fast charging station to a commercial fleet depot—site selection is a critical part of the process. Many criteria need to be considered, including not only potential traffic, but the amount of space available, the amount of power available, local regulations and incentives, the local permitting process, and much more.

Collecting all the information needed to compare potential sites and make a data-driven decision is a daunting task—and that’s where EVpin comes in. The company provides a set of tools to help charging providers with site selection and design. You can use EVpin’s database to evaluate different sites, and once you’ve identified a potential site, you can design your charging site right on the map using the same tool.

Charged spoke with CEO and founder Maythem Alsodani.

Charged: Who are your customers? Are they the CPOs, site owners, or…?

Maythem Alsodani: It’s a mix. We have companies like Prologis, ChargePoint, Blink, XCharge, Lynkwell, Electric Era, and then we also have companies that are focused on Level 2 charging, like EVPassport and EV+. We also have companies that are not in the charging business—for example, real estate investment companies. Everyone looks at the services we provide from their own point of view.

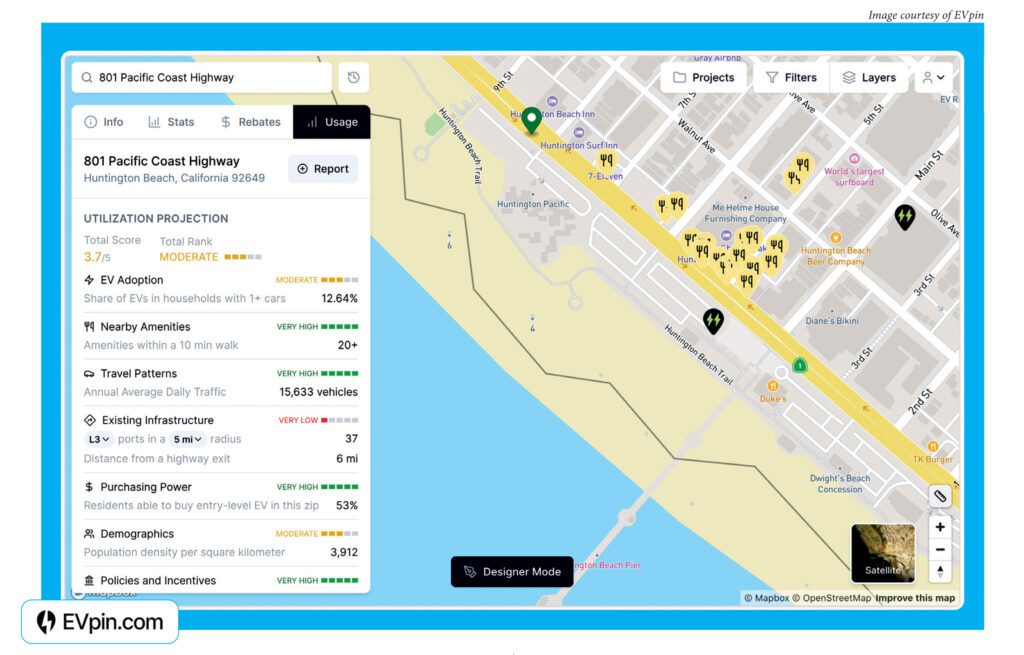

Our tool provides you with all the information you need to assess a site, including what utility operates there, how many cars are passing by on a given road, how many BEVs and PHEVs are registered in the area, what rebate programs are available. We also provide things like ownership information, zoning information, utilization of nearby charging stations and projected utilization scores.

What we’re trying to do is to help you answer the biggest question: Is this a site worth pursuing? And once that answer is there, you can design your site directly on the map. True-to-scale layouts that usually take 45 minutes to do manually, clients can do in a couple of minutes.

Charged: Is that the Spexbook feature?

Maythem Alsodani: No, the Spexbook feature is different. It helps you virtually build your site. Imagine you’re a CPO that’s pitching to Costco or one of these big retailers—a lot of times they have concerns about line of sight, if the chargers are blocking their signage or anything like that. Spexbook creates a true-to-scale 3D rendering of what the site would look like before it’s built. Clients can also use the renderings to help with expediting permits.

What we’re trying to do is to help you answer the biggest question: Is this a site worth pursuing? And once that answer is there, you can design your site directly on the map.

Charged: I can see how utilities and state agencies might be interested in using your data too.

Maythem Alsodani: A hundred percent of our customers are from the private sector. We do have some public agencies, but they’re free accounts. We offer a free tier so people can sign up and get to see the product.

Charged: What’s your background, and how did you start the company?

Maythem Alsodani: My background is in civil and infrastructure engineering. We started the company as Spexbook, and the original objective was to help architectural design firms make fewer mistakes when compiling drawing sets for contracts. Then one of the engineering firms said, “Why can’t you guys help us with 3D rendering?” So, we did a render for them. They were a client of a large CPO. The CPO saw it and absolutely loved it, and it helped them grow really fast.

Other CPOs started seeing our renderings, started requesting them, and all of a sudden, our renderings became the default service that people used for applying for permits or showing to big retailers when they were pitching them. We worked with virtually everyone with the exception of Tesla in that space.

We were awarded a site selection contract by one of the CPOs, and that gave us the idea for EVpin. They said, “We’ll give you a list of 150 sites, can you tell us the top 50 that we should pursue?” And we’re like, “Don’t you guys have a software tool?” And the answer was, “No. We used these 16, 17 different web sites to qualify a site.” So, we launched EVpin, an all-in-one tool for site selection, in July of 2023, and we’ve grown by 20 times since last year.

Charged: In the early days of EVs, nobody knew about site selection. For example, municipalities installed chargers in places where it cost them nothing, like at city hall or at the local college or library. Most of those never got used, and a lot of them have been ripped out.

Maythem Alsodani: There were companies that made that their strategy—to chase rebates and build these sites using rebates. A lot of these sites were built, and the utilization wasn’t there. They weren’t making money on them, and the whole premise of building a charging station is to make money from it.

But aside from that, I think in the early days it was easy to pick prime sites—for example a great intersection with a lot of cars. But when you get to where we are today, all the prime sites are taken—you want to evaluate other sites, and you need to take a data-driven approach to it.

Companies are getting a lot smarter with their money. The investment is really high, so you want to install stations in areas where they make the most sense. If every site costs you over a million dollars to build, you can go out of business if you get it wrong too many times.

Companies are getting smarter with their money. You want to install stations in areas where they make the most sense. If every site costs you a million dollars to build, you can go out of business if you get it wrong too many times.

Charged: Your services apply to all types of charging sites, but the criteria for choosing those sites must be different depending on the application.

Maythem Alsodani: Absolutely. For example, there are elements that are relevant to public charging that are not relevant to workplace or fleet charging sites. If you’re doing a fleet site, you may not look at nearby amenities—it doesn’t matter how many restaurants are nearby. Our approach is to give you all the facts. What’s relevant to you, even if you’re behind a fence, is understanding how much traffic is going by on a given day, understanding the zoning of the lot where you’re trying to build your depot.

If you’re installing EV charging for multifamily units, you want to know where the multifamily units are in a particular area. We allow you to search an address, we tell you where all the nearby multifamily units are, and we also tell you the number of EV registrations down to the zip code level. So, when you go to the property owner, you have all the information to present them with a case for why they should install charging. You can say year-over-year growth for EV registrations in this zip code is 34%, and this is the breakdown of the make and model of all these cars. You want to know what utility is operating in the area. It’s all there. You can just toggle it to see what interests you the most.

Also, you need to create a layout so you can present it to the owner and say, “This is how many parking spaces we’re going to use.” Because a lot of times they only allocate, for example, six parking spaces. They say, “That’s all we have to lease you.” Then you have to design it in such a way that you can fit all your support equipment and all the EV stalls to see how many chargers you can propose. Can you propose six? It all depends on the size of your equipment. We allow you to get a true-to-scale representation of how much space your layout will take.

You need to create a layout so you can show the owner how many parking spaces you’re going to use. We allow you to get a true-to-scale representation of how much space your layout will take.

Charged: Because you need space for your transformers and your switchgear.

Maythem Alsodani: Exactly.

Charged: Do some hardware providers have more compact switchgear? Can the customer look at different scenarios with different hardware providers?

Maythem Alsodani: Yeah. We offer an add-on service called Custom Layout—manufacturers give us the footprints for all their equipment and customers can see the clearances for that hardware and the different sizing options. Transformers come in so many different sizes. Same thing with the charger equipment, the charger pad. If you’re using XYZ charger manufacturer, it’s going to have a different pad size than another manufacturer.

Charged: That must be a project for you to keep up to date on all of that, because there’s new products coming out all the time.

Maythem Alsodani: Yes and no. The companies tell us which pieces of hardware they use, and a lot of companies have standardized on specific makes and models. There are companies that are kind of hardware-agnostic, but for a lot of these large companies, they’re very standardized.

Charged: I hear a lot about utility interconnects and how time-consuming and expensive that process can be. Is that a criterion that you can look at in the site selection process? For example, can I look at two alternate sites and see which one might be easier to get hooked up to the local utility?

Maythem Alsodani: Indirectly, yes, but unfortunately not everywhere. Right now we have a map layer called Power Capacity, and that tells you the power capacity down to the circuit level in any particular location in California served by the four major utility companies, as well as select areas in New York and a few other areas. If there is available power, the interconnection is going to be faster. If there is no power available, you’re looking to the utility to tell you how long it will take them to get a new service in.

Charged: I suppose you’re working on getting that data for the rest of the country too?

Maythem Alsodani: We recently added 11 new regions, showing the available power in 7 new states. All capacity data comes directly from utility companies via their APIs, showing you real-time available power at the voltage class provided by the utility. The data reflects the available power at a given time and is updated multiple times a week.

While we strive to provide the most current information, the data’s accuracy depends on the utility companies’ diligence in updating their systems. Some utility companies are very consistent with updates, others less so. It’s an ongoing conversation with the utilities.

Charged: I’ve heard quite a bit about conversations with utilities. There’s a couple thousand of them, they’ve all got different procedures, and some of them are more cooperative than others.

Maythem Alsodani: I know. Some don’t have the data centralized so they can share it with us. Some have the data very organized and updated regularly. It’s a mixed bag. I wish there was a standard way for an exchange of utility data nationwide rather than just going individually to each utility, but that’s not the reality.

Charged: So you need to have people on staff that are experts in the utility field.

Maythem Alsodani: Yep.

Charged: I hear a lot about microgrids that include battery storage and maybe solar generation. Does your design tool take account of those additional hardware elements?

Maythem Alsodani: It does in terms of where you want to lay it out, but it doesn’t get into the analysis of how big the battery storage needs to be for a site. It answers the question of how much footprint it will take up.

Charged: Utilities offer rebates and incentives, so it would make sense for them to look closely at their site selection process and make sure they’re giving the rebates to operators that are likely to get a lot of utilization. Do they do that? Do utilities take the time to vet those plans or do they just hand out rebates to whoever fills out their forms correctly?

Maythem Alsodani: I don’t think all utilities are equal. Some are a bit more diligent with it, but I think for the most part, utilization is not often a requirement. A lot of times they have a requirement for things like installing in a disadvantaged community, for example, but there’s little mention of utilization. There may be some that do consider potential utilization, but from what I’m aware, a lot of them just have a list of requirements, and if you meet them, and if there is available funding, you’ll get the rebate.

Charged: I would think the utilities that are more diligent about that are going to be more successful in the end because after all, they want to sell more electrons.

Maythem Alsodani: Exactly. Your question is a good one because it speaks to the incentives that both companies have, the charging network and the utility. At the end of the day, the charging station needs to make money, so that should always be the target. But there are different ways that people look at it.

A lot of utility rebates focus on multifamily units, for example, so utilization is of less importance because it’s just providing charging to the community. The biggest bottleneck right now is people that don’t live in a single-family home, and want to buy an EV, but they can’t because their co-op doesn’t offer charging. It’s kind of a chicken-and-egg-problem. You need to have charging first, then people can buy EVs. If there is no charging, you wouldn’t buy one. A lot of times there is a well-intentioned set of rebates for multifamily units or offices, and the utilization bit is not there for a reason.

There may be some utilities that consider potential utilization of a site, but a lot of them just have a list of requirements, and if you meet them, you’ll get the rebate.

Charged: What do you have to say about curbside charging?

Maythem Alsodani: Curbside charging is absolutely needed, especially in areas like New York City, for example. You can’t install many superchargers in the heart of Manhattan because of the real estate limitations, and that’s where curbside charging comes in.

We have a map layer called Population Density—we show you the population density per square kilometer, so you can correlate the number of people living there with the amount of traffic that passes by on a given day. We want to get better at it by also showing where all the street parking is in a city. We don’t do that today because unfortunately there isn’t a public database of this information that’s reliable, so you have to go the manual way and aggregate it city by city, but it’s something that we want to get into because as soon as you install them, the utilization rates can be extremely high. There’s a curbside charger in Brooklyn, and every single time I walk by it, there’s a car charging.

Charged: When some charging providers do their site selection, they may target more affluent, early-adopter people. Some of the state incentives, like in California, seem to do the opposite—they’re encouraging companies to build chargers in disadvantaged areas.

Maythem Alsodani: That has changed because the price of an EV has gone down significantly. An EV is no longer a car for the affluent, it’s almost at price parity with an ICE vehicle. And you don’t want to have this societal disparity where charging is only in affluent neighborhoods.

As part of our analysis, we factor in the entry-level price of a new EV, and we look at income data and tell you how many people can afford to buy an EV in a given area. We have seen the prices drop significantly. It was a six-figure car, not many people could afford it, so the early strategy for a lot of charging networks was to go where the money is. But now we’re seeing a lot of non-affluent individuals buying EVs because it’s a cheaper choice for them, and these people also need charging.

Charged: So, when you install in a disadvantaged community, you’re betting on future growth as opposed to going where the cars already are.

Maythem Alsodani: Exactly. And you also want to be able to eliminate charging deserts. A lot of the public charging idea is to get from A to B without having to worry, the same way when you drive a gas car, you know there’s going to be a gas station somewhere along the route you’re driving.

Charged: We’ve been talking about planning new stations, but do you also offer usage data for existing stations?

Maythem Alsodani: We recently launched EVpin Max, a feature that’s focused on enterprise clients where they’ll get to see session data, how much utilization, how much revenue in an area. It’s really specific, down to the station level. This service is now live, and we have a few known players in the industry who are using it.

A lot of times people think only about the average utilization in an area. But utilization is very nuanced—for example, if one DC fast charging station has 50 kilowatts and another station has 250 kilowatts, there may be a very different utilization profile between the two. And then if one has eight stalls and one has two stalls, they’re going to have very different profiles.

Our clients are going to be able to look at this information and see the difference between existing stations that have very few stalls and existing stations with a lot of stalls, and to look at the difference in utilization and correlate that with a different kilowatt rating for each station. All this information allows you to get even deeper into data-driven decisions, because you are no longer guesstimating, you are using existing data to predict what will happen, given user behavior.

Charged: Isn’t some of that information proprietary? Do CPOs share their usage data to a certain extent?

Maythem Alsodani: Yes, it is largely proprietary. We are currently working on partnerships with some CPOs, and we acquire some of the data through a third-party vendor. Some CPOs are interested in sharing their data with us. It’s an exchange of benefits, because they get to see it visualized in our tool in a way that’s simple and user-friendly for their sales and deployment teams. In other words, the providers are willing to share this information in exchange for something, and that’s how partnerships get formed.